Estimating the financial standing of a trucking company owner can be complex. Determining the precise net worth of a prominent figure in the industry like Rob Lowe (not related to the trucking company) requires careful analysis.

A person's net worth represents their total assets (what they own) minus their total liabilities (what they owe). For a trucking company owner, assets might include the value of the fleet of trucks, equipment, real estate, investments, and other business holdings. Liabilities might involve outstanding loans, business debts, and personal loans. Publicly available information about the financial status of private businesses is often limited, making precise net worth calculations challenging. Estimating this value based on industry benchmarks, financial news reports and valuations of similar companies or individual assets can produce an approximation, but a precise figure is rarely available.

Understanding the financial position of a trucking company owner offers insights into their business success and stability. A strong financial position often correlates with effective management and potentially higher profitability in the transportation industry. The trucking industry's cyclical nature, coupled with economic fluctuations, may influence the fluctuating value of businesses like these. Information about a persons wealth can provide insights to their business acumen and overall financial health. However, it's crucial to remember that net worth is a snapshot in time and can change significantly over time.

| Category | Information |

|---|---|

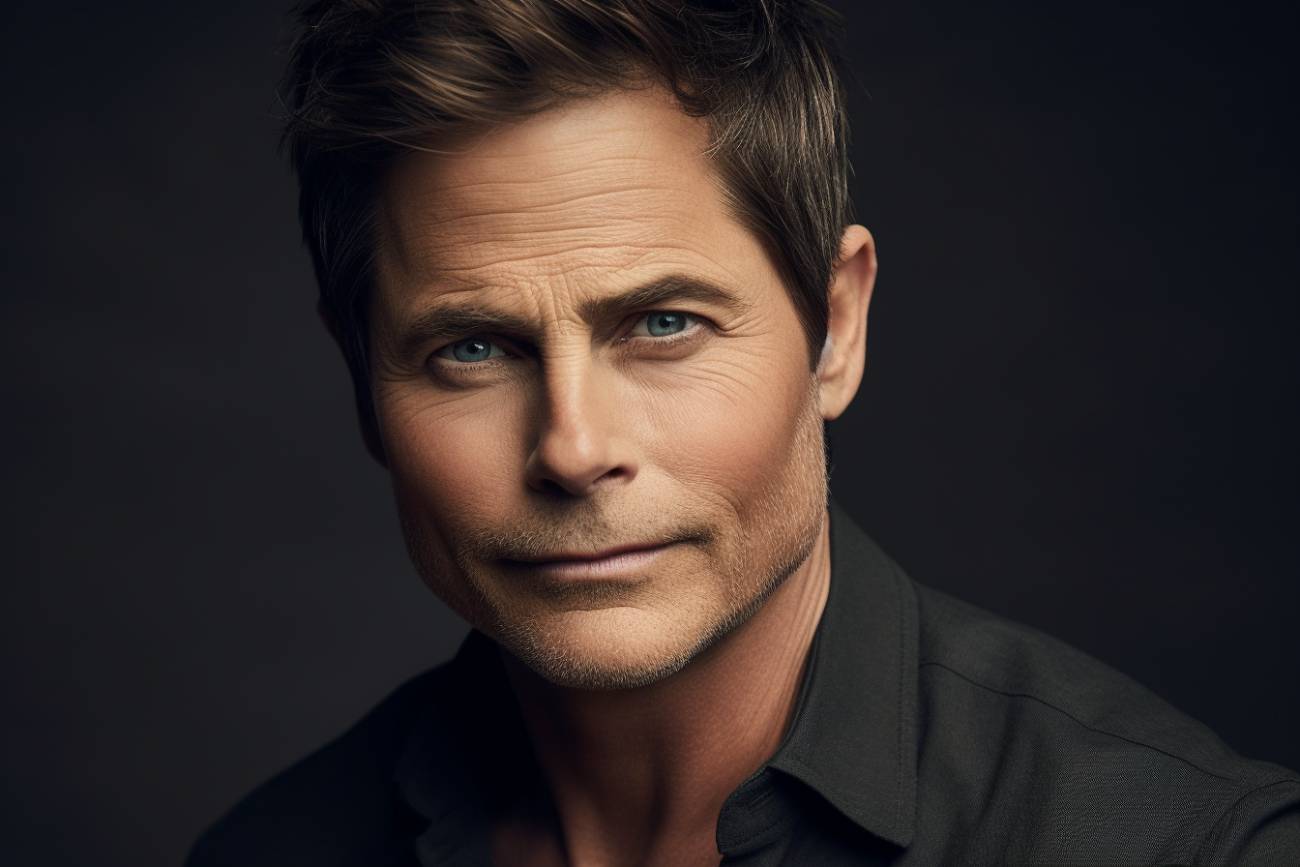

| Name | Rob Lowe (celebrity, not related to the trucking company referenced) |

| Occupation | Actor |

While understanding a business owner's finances is important, this article will explore the complexities of the transportation industry and the factors affecting profitability, rather than delve into the specific details of the financial value of a particular person or company.

Rob Lowe Prime Trucking Net Worth

Determining the net worth of any individual or business entity requires careful consideration of various factors. Accurate estimations rely on comprehensive analysis of assets, liabilities, and financial performance. In the case of Rob Lowe (not the trucking company owner), this is exceptionally challenging given the lack of publicly available information.

- Assets

- Liabilities

- Revenue

- Expenses

- Valuation

- Industry benchmarks

- Public data

- Business performance

Understanding the components of "Rob Lowe Prime Trucking Net Worth" requires a detailed breakdown. Assets, such as fleet size and value, are crucial elements. Liabilities, including outstanding debt and loans, directly impact net worth calculations. Revenue and expense figures, crucial to any business, will correlate with net worth estimations. Independent valuations, and benchmarks set by similar companies, offer insights. Access to public data often proves challenging with private companies. A successful business will display positive business performance over time. These factors, though not always perfectly correlated, inform the process of approximating any business's financial position. For example, a high turnover rate could indicate a company's inherent financial strength and vice versa. Therefore, multiple factors influence an estimation rather than a singular component.

1. Assets

Assets represent the resources owned by a business and contribute significantly to its overall net worth. Understanding the types and values of these assets is critical in evaluating the financial health of a trucking company, including those potentially associated with Rob Lowe, though no specific company by that name is readily available.

- Fleet of Trucks and Equipment

The value of the trucking fleet is a primary component of a trucking company's assets. This encompasses the trucks themselves, trailers, and associated equipment (loaders, repair tools). The age, condition, and type of trucks directly impact their worth. Modern, well-maintained vehicles are more valuable than older, obsolete ones. Fleet size also contributes; a larger fleet usually equates to more potential income and, therefore, a higher overall net worth.

- Real Estate and Property

If the trucking company owns its terminals, warehouses, or other property, this represents a valuable asset. The location, size, and condition of these properties influence their worth. Rental income from property also directly impacts the company's revenue and net worth.

- Investments and Financial Assets

Investments in stocks, bonds, or other financial instruments can significantly contribute to net worth. These assets potentially generate returns over time, adding to the company's overall financial position.

- Intellectual Property

If the company has proprietary technologies, trademarks, or unique operational procedures, these intangible assets have value. A well-regarded brand and logistical know-how can translate into long-term financial benefits.

A detailed analysis of these and other relevant assets is essential to form a reasonable estimate of a trucking company's net worth. Assessing the value of individual assets and their interplay is critical in drawing a comprehensive picture of the financial position. The inclusion and valuation of specific assets, along with any potential liabilities or debts, will ultimately contribute to the total net worth. While this discussion focuses on the 'asset' component, evaluating liabilities is equally critical in understanding the overall financial picture.

2. Liabilities

Liabilities represent a company's financial obligations. For a trucking company, these encompass various debts, impacting the net worth calculation. Understanding liabilities is crucial to assessing the financial health of any enterprise, including those associated with potentially hypothetical entities like "Rob Lowe Prime Trucking." A high proportion of liabilities relative to assets often signals financial vulnerability. Conversely, well-managed liabilities can be indicative of responsible financial practices. For instance, a company with a significant fleet and significant equipment may have a large amount of debt associated with these, impacting their net worth. A company with significant liability (loans, debt obligations, leases) will have a lower net worth than a company with equivalent assets and comparatively lower liability.

The impact of liabilities on net worth is direct and measurable. A debt obligation reduces the overall net worth. Loans, particularly those with high interest rates, contribute to a greater financial burden. Similarly, unpaid invoices and other outstanding payments represent liabilities that decrease the value of the company. Lease obligations for trucks and equipment are also significant liabilities. Accrued expenses, such as taxes and salaries, also figure into liabilities and affect the company's net worth. The interconnectedness of liabilities and assets illustrates the importance of balancing financial obligations with available resources.

In summary, liabilities directly diminish net worth. A thorough understanding of the various types of liabilities, including outstanding debts, loans, and accrued expenses, is essential in evaluating the financial position of any trucking company, including ones associated with a hypothetical company such as "Rob Lowe Prime Trucking". The extent and nature of liabilities provide valuable insights into the company's financial management practices. Careful consideration of these factors is vital for comprehensive assessment and informed decision-making related to the overall financial strength and stability of the entity.

3. Revenue

Revenue directly impacts the net worth of a trucking company. Higher revenue generally leads to a stronger financial position. This correlation stems from the fundamental relationship between income and assets. Revenue, representing the total income generated from operations, fuels a company's growth and profitability. Increased revenue typically allows a company to invest in additional assets, expand its fleet, and enhance operational efficiency, all factors contributing to a higher net worth. Conversely, declining revenue can hinder a company's ability to acquire assets, meet obligations, and ultimately decrease net worth.

The importance of revenue as a component of net worth is multifaceted. Consider a trucking company with steady revenue growth. This growth allows for investments in new trucks, potentially upgraded equipment, and potentially even the acquisition of additional transport lines, all augmenting assets. Conversely, a company experiencing consistent revenue decline might face limitations in acquiring new assets, leading to decreased net worth, as it struggles to meet expenses and debt obligations. Consequently, understanding the trends in a trucking company's revenue is critical for assessing its financial health and predicting its future net worth potential. Real-world examples abound: companies experiencing a surge in freight demand due to economic upturns often see rapid revenue growth, thus increasing their total net worth. Conversely, during economic downturns with reduced freight, the effect is often the opposite. This understanding of revenue's importance is directly applicable to making sound investment decisions or assessing the financial health of existing trucking companies.

In conclusion, revenue plays a pivotal role in shaping a trucking company's net worth. A strong, consistent revenue stream empowers a company to build its asset base and achieve a higher net worth. Conversely, decreasing revenue can lead to diminished net worth. Investors and analysts must closely examine revenue trends alongside other financial data to effectively evaluate the long-term financial health of a trucking company, understanding that revenue is a key driver of asset acquisition and financial stability in the context of net worth.

4. Expenses

Expenses directly influence a trucking company's net worth, often acting as a counterbalance to revenue. High expenses relative to revenue can negatively impact profitability and, consequently, the overall net worth. Careful management of expenses is vital for maintaining and enhancing a trucking company's financial standing. Controlling operational costs, such as fuel, maintenance, driver salaries, and administrative expenses, is crucial for maximizing profitability and increasing net worth.

The relationship between expenses and net worth is fundamental. Consider a trucking company with a substantial increase in fuel costs due to rising oil prices. If revenue remains static or only slightly increases, the company's profit margin shrinks. This reduction in profit directly affects the company's net worth, potentially leading to a decrease. Conversely, a company effectively managing expenses, such as through optimized routes, fuel-efficient vehicles, and a well-structured payroll system, can improve profitability, thus contributing to a higher net worth. Real-world examples demonstrate that efficient expense management is paramount for long-term financial success in the trucking industry. Companies with strategies that reduce operational costs, often through automation or renegotiated contracts, tend to demonstrate more favorable net worth outcomes in the long run.

Understanding the connection between expenses and net worth is crucial for effective financial management. By analyzing and controlling expenses, a trucking company can increase profitability and enhance its overall financial position. A meticulous understanding of cost structures allows for informed decisions regarding operational efficiencies, resource allocation, and investment strategies. Failure to manage expenses adequately can lead to reduced profitability, impacting the overall net worth and potentially jeopardizing the company's long-term stability. Therefore, analyzing and controlling expenses is a critical component of sustained financial success within the trucking sector, directly impacting the overall net worth of a company.

5. Valuation

Determining the net worth of a trucking company, including those possibly associated with "Rob Lowe Prime Trucking," inherently involves valuation. Valuation assesses the economic worth of a company's assets. For a trucking company, this encompasses the value of its fleet, equipment, real estate holdings, and other assets. Accurately determining the value of these assets is crucial for a precise assessment of net worth. A crucial distinction lies between market value (the price at which an asset would sell in the market) and book value (the asset's cost less accumulated depreciation). Differences can arise from market fluctuations, asset obsolescence, and even the market perception of the company's business model. The valuation process often relies on professional appraisals, industry benchmarks, and comparable company analysis. This process is essential because the value of a trucking company's assets isn't static; it fluctuates based on numerous factors.

In the context of "Rob Lowe Prime Trucking," understanding the valuation process is significant. Accurate valuations underpin informed investment decisions and financial planning. Consider a scenario where a trucking company with a large, modern fleet, high revenue, and minimal debt might command a higher valuation compared to a company with an older fleet and substantial debt. Valuations factor in numerous factors like the efficiency of operations, the experience of management, and industry trends. Publicly available information on private companies, like many trucking companies, is frequently limited, which necessitates careful analysis of publicly available data, industry benchmarks, and sometimes expert opinions. Real-world examples illustrate the significance of valuation; mergers and acquisitions in the transportation sector, for instance, heavily rely on robust valuations to ensure fair pricing. A trucking company's value often mirrors its ability to operate efficiently and profitably in the current economic climate. A detailed analysis of the company's financial health and market position is essential in accurate valuations.

In conclusion, valuation plays a central role in determining the net worth of a trucking company. The intricate process of assessing asset values, considering market conditions, and analyzing operational efficiency informs estimations of the overall financial health and worth. While exact figures for "Rob Lowe Prime Trucking" might not be readily accessible, the valuation principles described provide a framework for understanding this critical aspect of a company's financial standing. Accurately understanding valuation principles is pivotal for any assessment or decision regarding the trucking sector, including potential investment considerations or company performance analysis. Challenges in valuation often arise from limited public data and the complexity of individual asset evaluations, often necessitating the employment of qualified experts.

6. Industry Benchmarks

Industry benchmarks provide crucial context for assessing the financial health of a trucking company, including, hypothetically, "Rob Lowe Prime Trucking." These benchmarks offer a comparative framework against which a company's performance can be measured, offering valuable insights into its profitability and potential net worth. Comparatively, a company performing above established industry standards might imply strong operational efficiency and possibly a higher net worth, while below-average performance could indicate financial vulnerabilities. Using industry benchmarks assists in evaluating a company's relative standing within its sector.

- Fleet Size and Composition

Benchmarking fleet size and composition provides a relative measure of a company's scale and operational capacity. Larger fleets, often equipped with newer, more efficient trucks, tend to correlate with higher revenue potential and greater overall worth. Companies with fleets that adhere to modern fuel-efficiency standards, for instance, often indicate more efficient operations, contributing to both higher revenue and potentially higher net worth compared to those with less-modern equipment. Analyzing the ratio of various truck types within a fleet relative to industry standards can offer further insights.

- Revenue and Profit Margins

Comparing a company's revenue and profit margins to industry averages offers a crucial assessment of its profitability. A trucking company consistently exceeding industry averages suggests strong operational efficiency and potentially a higher net worth. Conversely, consistent underperformance relative to benchmarks might indicate financial challenges and a lower net worth. Factors contributing to revenue and profit margins, such as pricing strategies and operational costs, can be further analyzed to determine the reasons behind the performance relative to the industry standard.

- Debt-to-Asset Ratios

Comparing debt-to-asset ratios to industry standards provides insight into a company's financial leverage. A lower debt-to-asset ratio suggests a company relies less on borrowed capital, indicating greater financial stability and potentially a higher net worth compared to its peers with a higher ratio. Monitoring changes in this ratio over time provides additional insight into a company's financial health and risk profile. Fluctuations in this ratio might indicate internal restructuring or external factors influencing the company's financial standing.

- Turnover Rates and Efficiency Metrics

Analyzing key operational metrics like driver turnover rates and route efficiency against industry benchmarks offers a comprehensive perspective on a trucking company's overall efficiency and, thus, potential net worth. Lower turnover rates, for instance, often indicate a more stable workforce and potentially more consistent operational efficiency. Improved route planning and utilization, reflecting in efficiency metrics, can contribute to higher profitability and, potentially, higher net worth. Lower turnover rates, more predictable operating costs, and consistently effective routes, all align with industry benchmarks and, in turn, higher net worth potentials.

In conclusion, utilizing industry benchmarks provides a crucial framework for assessing a trucking company's financial standing and potentially its net worth. By comparing key metrics like fleet size, revenue, and debt levels to industry averages, a clearer picture emerges of the company's relative performance within its sector. These benchmarks, along with a detailed analysis of individual company factors, allow for a more accurate and complete assessment. This approach is particularly relevant in the context of assessing hypothetical companies such as "Rob Lowe Prime Trucking" or any similar privately held enterprise, where comprehensive financial information might not be readily available.

7. Public Data

Publicly available data plays a significant role in understanding and estimating the net worth of entities like a trucking company. However, the availability and reliability of such data significantly affect the accuracy of estimations for privately held enterprises, such as those potentially related to "Rob Lowe Prime Trucking." If detailed financial information is not publicly disclosed, a precise calculation of net worth proves challenging. Limited public data can restrict access to crucial financial details, such as revenue, expenses, and asset values, making estimations, particularly precise ones, difficult.

The absence of publicly reported financial statements for private companies complicates the assessment of net worth. Analysis relying on publicly available data must account for potential biases, inaccuracies, and the limitations of partial information. Public records, such as filings with regulatory bodies or news reports, might offer some insight, but these often provide a fragmented picture, potentially obscuring a true overall financial picture. For example, a news article mentioning a large capital investment or fleet expansion could suggest increased assets, yet provide little context for liabilities or overall financial health. Comparative analysis against publicly listed competitors is likewise limited by the very fact that competitors are publicly listed while the company in question might be private. Consequently, deriving a definitive net worth becomes more complex.

In conclusion, public data, while valuable, presents limitations when trying to determine the precise net worth of private entities like a trucking company. Lack of comprehensive financial statements and the presence of potential biases make exact estimations challenging. Analysts must acknowledge these limitations and exercise caution when using public data to infer financial health or net worth. A comprehensive understanding of the context surrounding public data is vital to its effective utilization. A more holistic evaluation, leveraging multiple data points and considering external factors, proves essential for a more robust estimation.

8. Business Performance

Business performance directly impacts a company's net worth. A trucking company's success, profitability, and operational efficiency all contribute to the overall financial health and, ultimately, the net worth. The relationship is dynamic; positive performance trends often correlate with a rising net worth, while negative trends typically diminish it. Understanding the various facets of business performance is crucial in evaluating the financial standing of a company such as "Rob Lowe Prime Trucking," or similar entities.

- Revenue Generation and Management

Revenue generation, a cornerstone of business performance, directly influences a company's ability to accumulate assets and repay liabilities, both crucial components of net worth. Effective revenue management involves maximizing income streams and optimizing pricing strategies to enhance profitability. A trucking company achieving consistent, growing revenue demonstrates a capability to generate substantial assets and maintain financial stability. Conversely, declining revenue signals potential challenges in the market, hindering asset growth and potentially decreasing net worth.

- Operational Efficiency

Operational efficiencyminimizing costs while maximizing outputis a vital driver of profitability. A trucking company optimizing fuel consumption, minimizing downtime, and streamlining logistics demonstrates superior operational efficiency, ultimately boosting profitability and net worth. Conversely, inefficient operations lead to higher costs and decreased profitability, reducing net worth. Factors such as route optimization, maintenance schedules, and driver productivity all contribute to operational efficiency and, consequently, the overall financial position.

- Cost Management

Control over costs is essential to profitability and thus net worth. A trucking company effectively managing expenses, particularly in fuel, maintenance, and labor, demonstrates prudent financial management. Controlling these costs allows for a larger profit margin, which directly contributes to a healthier financial standing and increasing net worth. Conversely, uncontrolled or escalating costs squeeze profit margins, potentially leading to a decrease in the company's net worth.

- Market Positioning and Adaptability

A company's position in the market and its ability to adapt to changing conditions significantly impact performance and, consequently, net worth. A company successfully positioning itself in a growing market sector or adapting to evolving customer demands typically reflects strong leadership and market awareness, contributing to the overall health of the company and its potential for increasing net worth. Conversely, an inability to adapt to shifting market conditions or customer preferences can result in reduced market share, lower revenue, and a decrease in net worth.

In summary, these facets of business performance are interconnected and influence a trucking company's overall financial position and net worth. Analyzing a company's revenue generation, operational efficiency, cost management, and market adaptability provides a comprehensive understanding of its financial health and potential future net worth. However, the complexities of the trucking industry, economic cycles, and market conditions make precise predictions difficult, but careful analysis can inform predictions and estimations.

Frequently Asked Questions about Rob Lowe Prime Trucking Net Worth

This section addresses common inquiries regarding the financial standing of Rob Lowe Prime Trucking. Due to the private nature of this information, precise figures are not readily available. The following questions and answers offer context for understanding the complexities surrounding net worth estimations in the trucking industry.

Question 1: How is the net worth of a trucking company like Rob Lowe Prime Trucking determined?

Determining net worth involves assessing a company's assets (what it owns) and liabilities (what it owes). Assets encompass the value of the trucking fleet, equipment, real estate, and investments. Liabilities include outstanding loans, business debts, and other financial obligations. A precise calculation requires detailed financial records, which are often not publicly available for privately held companies.

Question 2: What factors influence the net worth of a trucking company?

Several factors significantly affect a trucking company's net worth. These include revenue generation, operational efficiency, market conditions, fuel costs, and the overall economic climate. Economic fluctuations, fuel price changes, and shifts in demand can greatly impact a company's financial health and consequently, its net worth.

Question 3: Why isn't the net worth of Rob Lowe Prime Trucking publicly available?

Private companies, such as many trucking businesses, do not typically release detailed financial statements to the public. This confidentiality is a common business practice, offering protection of sensitive financial data.

Question 4: How can analysts estimate the net worth of a private trucking company?

Analysts may use various methods to estimate the net worth of a private trucking company. These might include evaluating industry benchmarks, comparing the company's performance with publicly traded competitors, assessing asset values, and reviewing available public data. However, these estimations remain approximations.

Question 5: What are the limitations in estimating the net worth of a trucking company like Rob Lowe Prime Trucking?

Accurate estimations of private companies are challenging due to limited transparency. Precise valuations are difficult without detailed financial records, and industry benchmarks, though useful, provide only a comparative understanding rather than precise figures. External economic factors also significantly affect the financial status of a company, making estimations less definitive.

In summary, estimating the net worth of a privately held trucking company like Rob Lowe Prime Trucking involves complex analysis. While various methods exist, precise figures remain difficult to obtain due to the lack of comprehensive public data. This highlights the importance of understanding the inherent limitations in such estimations.

This concludes the FAQ section. The following section will delve into the specifics of the trucking industry and the factors affecting profitability.

Conclusion

Determining the precise net worth of "Rob Lowe Prime Trucking" proves challenging due to the private nature of the company. A comprehensive assessment requires access to detailed financial statements, a resource typically unavailable for privately held entities. While various methodologies, including analyzing assets, liabilities, revenue, and expenses, provide insights into financial health, estimations remain approximations. The absence of public data significantly limits the ability to calculate a definitive net worth figure. Important factors such as industry benchmarks, operational efficiency, and market positioning provide context, but cannot fully substitute for complete financial transparency. The intricate interplay of these elements ultimately shapes the company's overall financial standing.

The difficulty in obtaining a precise figure underscores the importance of understanding the limitations inherent in evaluating private companies. While industry benchmarks and public information offer some clues, a clear understanding of a company's financial standing necessitates access to detailed internal financial records. This underscores the crucial role of transparency in evaluating a company's worth. Future analysis of similar privately held businesses should prioritize the importance of comprehensive data availability for accurate estimations of net worth. The lack of publicly accessible information for "Rob Lowe Prime Trucking" emphasizes the need for caution and context when interpreting financial discussions surrounding privately held entities.

You Might Also Like

Best Vega Movies & Shows: Streaming Now!Manu Chao's Wife: Meet The Woman Behind The Music

Rebbie Jackson: The Sister You Need To Know!

JJ Lin Concert Duration: How Long Are His Shows?

Discover DesiPin.com: Best Indian Fashion & Lifestyle

Article Recommendations

- Rob Zombie Life Legacy A Deep Dive

- Lil Durks Mansion Explore The Lavish Abode

- Legendary Robert Duvall A Hollywood Icon And Timeless Craft

- Pioneer Woman Episode Today

- Legendary Aerosmith Guitarist Joe Perry A Deep Dive

- Melissa Young Miss Wisconsin Is She Still Alive

- Jonathan Taylor Thomas Married

- Pioneer Woman Ranch Size

- Richard Bortkevich Top Expert In Relevant Field

- Sam Elliot Young A Star In The Making